It’s tax time. How does this money affect your cases?

Note: this will help those of you who either don’t have a wildcard exemption or have used up the exemption with other assets.

As you examine a case you are writing, look for the history of tax refunds from their old 1040’s and state tax records. If you see a likely refund coming, you may want to consult the attorney and warn of the jeopardy to the pending tax refund.

As you examine a case you are writing, look for the history of tax refunds from their old 1040’s and state tax records. If you see a likely refund coming, you may want to consult the attorney and warn of the jeopardy to the pending tax refund.

On the day that your client files, all of their property, including unpaid tax refunds, will fall under the control of the Chapter 7 trustee. The trustee has temporary control of this property and will look for any nonexempt property that he or she can take for the benefit of creditors.

Assets like cash, balances in bank accounts, stocks and of course tax refunds, are nonexempt assets under most state laws and can be taken by the trustee. There are certain exceptions to this rule, but generally, you should plan to work closely with the attorney to learn how to protect these assets before filing the client’s case.

Here is how you can explain this concept to the client:

Tax refunds and Chapter 7

See below, to see how we touch on Tax Refunds and Chapter 13.

As you work throughout the year, you become the owner of your pending tax refund. For example, on July 1, 2012, you are the owner of 1/2 of the tax refund you plan to receive in early 2013. Therefore, if you file your Chapter 7 bankruptcy on July 1, the trustee will have the right to demand that you pay to him or her 1/2 of your refund when you receive it the following year.

Our experience shows that during the latter part of the year, trustees become interested in the following year’s tax refunds. For example, if your hearing (which takes place approximately 5 weeks after you file) is set after August 1, you can expect the trustee to ask you to plan on turning over next year’s tax refund when you get it the following year.

However, you are only expected to turn over the prorated share of the refund that you had earned up the date that you file. Again, to illustrate this point, if you file on October 1, you will have worked 3/4 of the year. At your hearing in early November the trustee will ask you to turn over 3/4 of your tax refund when you receive it. Some trustees will lead you to believe they are entitled to the entire refund, which is not accurate.

If you file after the new year begins and before you get the refund, the trustee will ask for the entire refund. For many clients who file in January or February, they must file to stop a foreclosure, garnishment or repossession that will take place before they get the refund. These clients will plan to forfeit their refund.

Ideally, you will be able to postpone your filing until after you receive the refund and spend it appropriately. Generally, if the money is spent to fund your bankruptcy case, purchase exempt property, pay your rent or mortgage or used for living expenses, the trustee will not ask for the money. You will need specific guidance from your attorney before you spend cash that you have in your possession before you file a bankruptcy case. If you file your case in late Winter or the Spring, the trustee will routinely ask you how you spent any refund that you had received and you may be required to produce receipts to prove it was spent appropriately.

Finally, it is important to remember the purpose of a Chapter 7 is to make any nonexempt assets available to the trustee so he can give something to your creditors. Often, clients will plan to let go of certain assets or some cash knowing it is a small price to pay for a complete discharge of their debt.

Tax refunds and Chapter 13

Most jurisdictions require a Chapter 13 client to turn over a portion of their tax refund during each year they are in a Chapter 13 plan. If you have not yet filed for a client who is going into a Chapter 13, you will want to analyze their situation as you would a 7 above. However, the difference is, the client will get to keep the refund, but will have to pay back any non-exempt portion in his or her plan.

The best move is to see if you can put off filing until the asset is delivered to the client and they have a chance to convert it to non-exempt status with the help of their attorney. You’ll see how we have given a rough guideline on how to spend non-exempt cash just before filing to avoid a trustee asking for turnover.

If you have a Chapter 13 client who has already filed and is in a confirmed Chapter 13, then tax time is still important. If you provide paralegal support on open Chapter 13 cases, remember, the client will be required to turnover their refund to the Chapter 13 trustee. However, they get to keep some of it. In most jurisdictions, the debtor can keep the first $1,000 of the refund (Line 74a of the 1040 Form) and the first $1,000 of any additional child tax credit (Line 65 of the 1040 Form). Any amount left over would be turned over to the trustee.

Sometimes the client forgets or intentionally keeps the whole refund. This will result in a Motion to Dismiss filed by the Trustee. If you really want to make yourself valuable to your attorneys, offer to help write and file Motions to Abate and Retain Tax Refunds. At 713 Training we can give you the tools to offer these prepared documents. Also, and more importantly, we can help you file the documents that will give the attorney additional fees in the case for filing these motions.

How to Spend Tax Refunds Before Filing

In most jurisdictions, a Chapter 7 trustee, and sometimes the Chapter 13 trustee, will scrutinize how the client got rid of non-exempt assets right before filing. Here is a rough guideline that will help a client spend the money before filing. IT IS IMPORTANT the client consults closely with his or her attorney before spending non-exempt cash.

Here are the 4 categories you can use to convert this important non-exempt asset:

Bankruptcy Costs

-

- Filing Fee for your bankruptcy case. This is either $306 for Chapter 7 or $281 for Chapter 13.

- Attorney Fee

- Credit Counseling Certificate Fee

- Rent or Mortgage

- We have found trustees routinely allow debtors to pay their rent or mortgage for the current month in which they file and one additional month. So, for example, if you file on February 10th, you can use the cash to pay for February and March.

- Exempt Property

- We have given you a complete list of the property recognized by the state law as exempt. It is expected that debtors will perform pre-bankruptcy planning by consulting with their attorney to create the exempt property shopping list.

- Monthly Living Expenses

- Utilities

- Phone

- Car Repair and/or Maintenance

- Insurance payments

Sincerely,

The 713 Training Team

For more information about how you can become a Virtual Bankruptcy Assistant visit us at www.713training.com

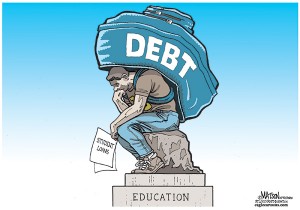

After a debtor files under Chapter 7, not all of the debts are always discharged when it is complete. It is difficult to convince a court to discharge student loan debts.

After a debtor files under Chapter 7, not all of the debts are always discharged when it is complete. It is difficult to convince a court to discharge student loan debts.